estate tax change proposals 2021

This amount could increase some in 2022 due to adjustments for inflation. New federal tax legislation is on the horizon with significant changes for estate and gift taxes.

Summary Of Fy 2022 Tax Proposals By The Biden Administration

However on October 28 and then again on November 3 the House Rules.

. Consumer IssuesConsumer Protection News and Events. It includes federal estate tax rate increases to 45 for estates over 35 million with further. There will be a limitation on gains deferred.

Decreased Estate Tax Exclusion. 2021 Estate Tax Proposals. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. Tax Changes for Estates and Trusts in the Build Back Better.

No change to the long-term capital gains tax rate. Both Senators and Representatives have proposed increasing the tax rate of taxable estates. Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022.

Estate Tax Rate Increase. Revise the estate and gift tax and treatment of trusts. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion.

Proposals to decrease lifetime gifting allowance to as low as 1000000. The current 2021 gift and estate tax exemption is 117 million for each US. Changes to the grantor trust rules.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. Would eliminate the temporary increase in exemptions. The generation-skipping transfer tax GST tax exemption amount will also decrease from 117 Million per person to 5 Million per.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Other Tax Increases Released in Bidens Budget Proposal. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000 per person for transfers occurring after December 31 2021.

Taxpayers who are considering substantial gifts or similar planning today. Click to play an audio version of this article. Rates remain the same for gains realized prior to September 13 2021.

One of the plans is reverting the estate and gift tax exemption to 5 million according to a summary of the proposals exposing estates and gifts above that amount to a 40 federal estate tax. Act BBBA The Build Back Better Act BBBA. November 16 2021 by Jennifer Yasinsac Esquire.

The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals published. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. A person can currently transfer up to 117 million of assets at death without incurring any Federal Estate Tax.

Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026. The maximum estate tax rate would increase from 39 to 65.

November 03 2021. The proposed impact will effectively increase estate and gift tax liability significantly. If a decedent were to die in 2021 with an estate of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the decedents date of death.

Following weeks of negotiations between President Joe Biden and congressional Democrats the White House released a retooled framework for the Build Back Better Act on October 28. The Biden Administration has proposed significant changes to the income tax system. The exemption was indexed for inflation and as of 2021 currently stands at 117 million per person.

Potential Estate Tax Law Changes To Watch in 2021. Estate and Gift Taxes. Under current law it is possible to create.

That is only four years away and Congress could still. The current estate tax exclusion for an individual is. Replace the 20 long-term capital gains tax with a 25 rate where total taxable income exceeds approximately 501000.

July 13 2021. The tax rate for C corporations will increase from 21 to 28. Reducing the Estate and Gift Tax Exemption.

By Cona Elder Law. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. What was considered a tax-free gift on December 31 2021 now becomes a taxable gift and incurs gift tax of 2565000.

Thankfully under the current proposal the estate tax remains at a flat rate of 40. The top marginal tax rate will increase from 37 to 396 for taxable income over 450000 for married individuals filing a joint return 400000 for unmarried individuals. President Bidens Build Back Better plan currently wending its way through Congress.

The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person. Enacted in the Tax Cuts and Jobs Act TCJA. Under the current proposal the estate.

In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. The 2021 exemption is 117M and half of that would be 585M.

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. Estate and gift tax exemption. If this proposal were to become law the potential drop in the exemption might be a reason to consider completing large gifts before year-end.

No change to the Unified Lifetime Estate and Gift Tax.

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

House Democrats Tax On Corporate Income Third Highest In Oecd

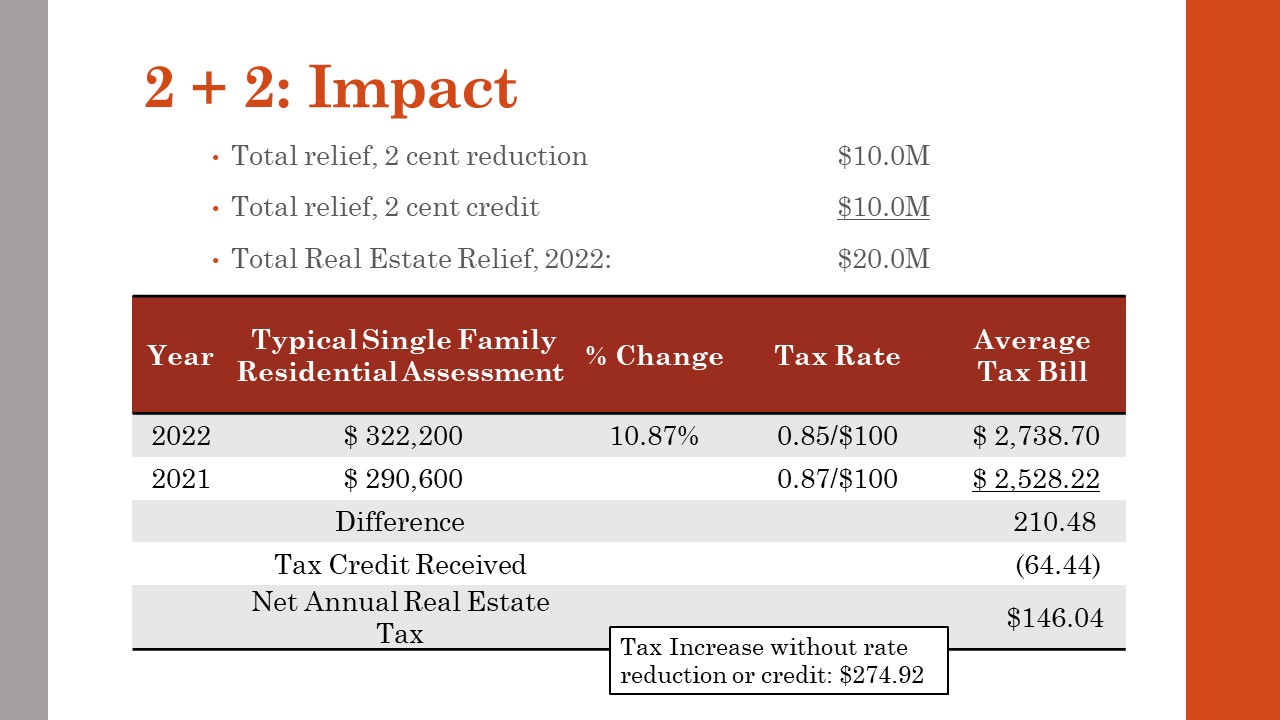

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Hill Democrats Shift From Raising To Cutting Taxes On The Merely Rich

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Biden Greenbook Estate Tax Proposals Should You Care

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

The New Death Tax In The Biden Tax Proposal Major Tax Change

Tax Increase Talk Prompts Wealthy To Splurge On Muni Bonds Bond Funds Corporate Bonds How To Raise Money

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra